PAT PILCHER dissects the Commerce Commission’s report into mobile phones in New Zealand, and finds that it’s deeply flawed.

Owning and using a smartphone in New Zealand is more affordable than it’s ever been. At least that’s what the Commerce Commission are saying in their preliminary findings in their review of the mobile market.

According to the review, “New Zealand is ranked number two globally in the GSM Mobile Connectivity Index 2018 across infrastructure, affordability and network performance.”

Vodafone is supportive of the findings, saying in a press release that, “We agree that pricing, coverage and choice of mobile services are all trending positively for New Zealand consumers.”

“The report says that the mobile market is competitive and healthy.”

So how healthy is New Zealand’s mobile market?

The report says that the mobile market is competitive and healthy. It says that retail prices are below OECD averages and that there is 98.5 per cent population coverage, as well as committed investment to extend coverage even further, along with three national competing networks, and 5G on the horizon that will deliver even more innovation and competition in the market.

But a closer look reveals dark storm clouds are looming large in the NZ mobile market.

Almost straight after the Vodafone press release arrived at Witchdoctor Towers, it was followed by a not so supportive press release from Vocus, who appears to have taken issue with the Commerce Commission’s glowing view of the MVNO market.

“Vocus are… staggered that the Commerce Commission considers the wholesale mobile market as healthy”

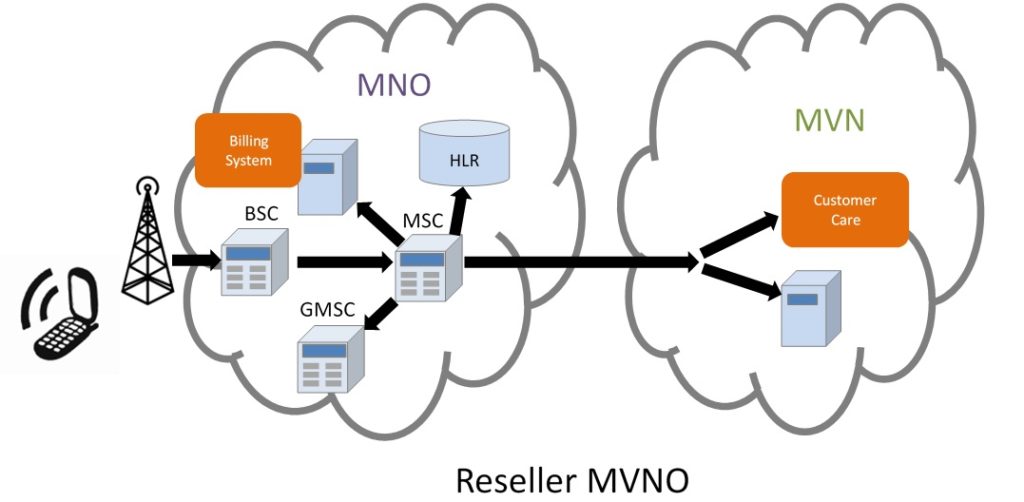

MVNO is telco speak for mobile virtual network operators. They are typically companies that gain wholesale access to a cellular network and can sell mobile telecommunications under their own brand.

Vocus said they are “staggered that the Commerce Commission considers the wholesale mobile market as healthy and evidence of competition exists with MVNOs.”

According to Vocus CEO, Mark Callender, the MVNO market is struggling: “We’ve been selling mobile plans through an MVNO for more than a decade now and have a grand total of 26,000 customers – and we are the largest MVNO in the country.”

This is because “mobile operators have been paying mere lip service to mobile competition and to propose measures to increase competition and benefit New Zealand consumers. Today’s preliminary findings that the MVNO market is operating as it should is disgraceful.”

“Today’s preliminary findings that the MVNO market is operating as it should is disgraceful.”

Callender says that 99 per cent of the estimated 5.5 million mobile connections in NZ are sold by three mobile network operators is clear evidence that MVNOs aren’t working in New Zealand.

So, if only 1 per cent of Kiwi mobile users are using an MVNO, what went wrong? Most MVNOs are ISPs who typically offer mobile services as an add-on for existing internet customers. Unlike Spark, Vodafone and 2Degrees, most MVNOs do not have a strong marketing presence. Skinny (who use Spark’s network) is perhaps the only exception to this. With most MVNOs literally just re-badging a mobile network operator’s mobile offering, there is also little room for innovation or crucially, differentiation, meaning that many MVNOs lack a compelling point of difference with their mobile offering.

The MVNO situation is a complex and highly politicised issue. If only 1 per cent of NZ mobile subscribers are using an MVNO, then perhaps a closer look and greater regulation of the MVNO market is needed.

MVNO issues aside, there’s also the not so small matter of the Huawei situation, whose impacts on competition in the mobile market could be huge.

The Government Communications Security Bureau (GCSB) raised objections to Huawei equipment being supplied to Spark because of alleged security concerns. Their move follows similar bans in the United States and Australia, whose governments have also expressed concerns about security issues.

I’m dubious about the GCSB’s decision. Both the UK and Germany have said that any perceived security issues can be mitigated, and have adopted a more reasoned approach compared to the rabidly anti-Huawei rhetoric out of the US and Australia. In New Zealand, as with other Five Eyes countries, the public is still in the dark as to what precisely these so-called security issues even are.

Huawei says that these issues are more to do with trade and geopolitics than cybersecurity, but until more details are made available, the jury is still out.

“It’s unlikely that 2Degrees can afford to do this and may be stuck with a 4G network”

The validity of the GCSB’s claims aside, should Huawei not be allowed to supply 5G equipment to NZ telcos, the impacts on the health of the market could be significant.

While Spark and Vodafone both have deep pockets and can afford to use the only other supplier in the market (Nokia), 2Degrees are another story.

“Nokia would, in effect, be freed from any competitive pressures and in a position to set prices accordingly.”

2Degrees used Huawei-supplied cell sites through to their network core. This means that while they may have had the option of reusing most core of its existing 4G network in an upgrade to 5G, it will need to be replaced if the GCSB’s stance remains unchanged.

Given the enormous costs, it’s unlikely that 2Degrees can afford to do this and may be stuck with a 4G network while its competitors race ahead with 5G.

Ultimately, this could render 2Degrees non-viable over the longer term, leaving New Zealand with just two mobile network operators, diminishing competition, which could, in turn, see pricing and innovation stagnate.

Equally significant is the fact that removing Huawei’s network business from the New Zealand market leaves just one other network player, Nokia. As the sole supplier of mobile network infrastructure in New Zealand, Nokia would, in effect, be freed from any competitive pressures and in a position to set prices accordingly. The upshot of this is that the two remaining telcos, faced with steeper costs to upgrade to 5G, would pass these costs onto customers.

The Commerce Commission needs to look at the potentially stark future facing New Zealand’s mobile market.